In 2020, we saw some large life settlement funds suspend their investors’ redemption rights, exposing a significant liquidity mismatch inherent in these open-ended funds. Some investors are also suspecting inflated valuations after fund managers stating that policies could only be sold at massive discount to carrying values.

History does not exactly repeat itself, but it often rhymes. This time maybe to the life settlement crisis that started around 2008? We believe it’s worth revisiting our 2015 paper on this subject.

When markets stop functioning

A common feature of illiquid assets is that sellers’ and buyers’ price expectations do not match, with these wide spreads resulting in non-functioning markets. While there are many reasons for this to happen, often, this is due to the assets being valued by pricing models using stale or over-optimistic input values.

Some market participants call this valuation approach ‘mark-to-myth’. In this brief note, we discuss why this is the case, particularly for many life settlement funds.

The journey of life settlement policies

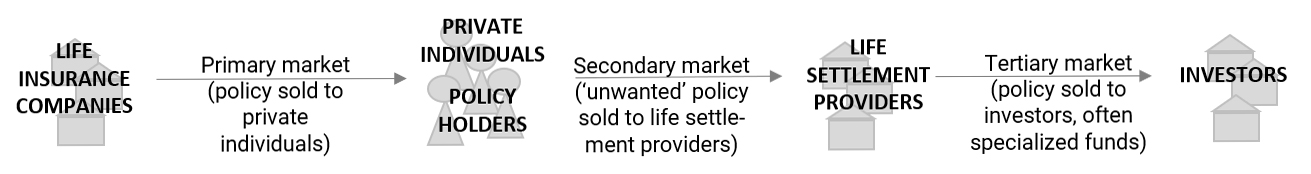

By way of background, life settlements are existing life insurance policies in the US that their original policyholders sold to a third-party. Such policies are sold to life settlement providers because a policyholder, for example, no longer needs or wants the policy for personal reasons. Another one is because future premium payments become unaffordable. The life settlement providers often sell the policies on to investors, usually wrapped in specialized investment funds, looking for attractive and uncorrelated investment opportunities. The marketplace can therefore be characterized as follows.

Figure 1: Illustrative description of life settlements market; source: Multiplicity Partners

While the primary and secondary markets are in the US, many investors in Europe have acquired life settlement funds or structured life settlement products. They might be interested in seeing increased liquidity in the so-called tertiary life settlement market.

Longevity spoiled the party

As it turned out, many life settlement providers were selling policies with unrealistically short life expectancies used in the pricing models.

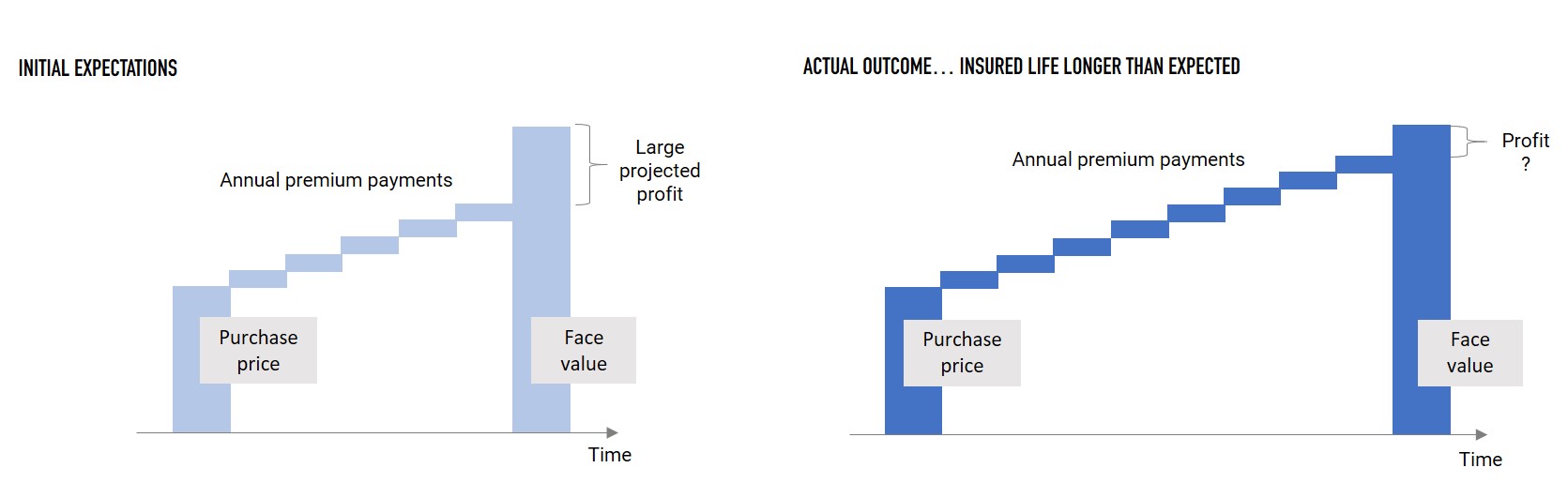

Figure 2: Illustrative cash flow profile of life settlement investments; source: Multiplicity Partners

Before the methodology to calculate life expectancy tables was significantly revised in 2008, many such life settlements were acquired by dedicated life settlement funds in Europe. They are affected twofold. Firstly, annual premiums have to be paid for much longer periods than initially expected, and receipt of the policy face values will occur much later than anticipated, materially eating into realizable profits. Secondly, making matters worse, investment funds that lack the liquidity or financing to continue paying premiums risk for the policies to lapse and may be forced into a fire sale, or even end up insolvent.

How market-based data providers changed valuation practices

In 2013, IFRS 13 accounting standards on ‘Fair Value Measurement’ were introduced, mandating that market-based pricing must be used wherever possible. Evindently, most life settlement funds or products should mark their books based on an ‘exit price’.

Many data providers are now able to deliver market-based input values for life settlement portfolios. There is no reason to hold on to discounted cash flow models that can justify any valuation, leaving investors at the fund manager’s will. Fund managers tend to inflate or at least keep valuations inflated, as a) fees are linked to the fund’s net asset values and b) write-downs seriously affect the potential for raising new assets.

It is, therefore, time for investors to start pushing their investment managers to use independent market-based input data in their valuation models. Also, investors should demand their managers to disclose the ratio of actual/expected deaths to assess the chosen life expectancy model’s input quality.

Liquidity ahead

Secondary market pricing for many life settlement funds is currently characterized by extremely steep discounts to their applied mark-to-myth valuations. As soon as life settlement funds start using a market-based valuation, we expect the tertiary market’s liquidity to pick up substantially. This will allow investors to exit their investments near the official market valuations, even if that means crystallizing unrealized losses currently not reflected in the valuation.

Please do not hesitate to contact us if you wish to discuss exit options for your life settlement investments. Please write to Andres today at ah@mpag.com, or call him at +41 44 500 4555.