There is a range of motivations to sell certain LP interests in the secondary market, just as there are many reasons to invest into private market funds. While the private equity secondary market is far from perfect, price discovery is usually efficient enough for secondary sales to represent a tactical option to LPs. In this article we explain the most common reasons for selling LP interests, and how the sellers and their motivations developed over time.

LP interests are sold on the secondary market for a variety of reasons

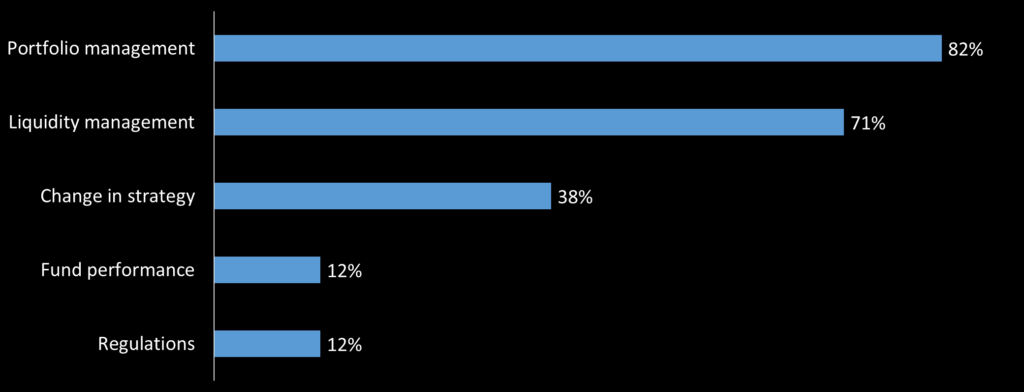

Portfolio and liquidity management are the main motivations for selling LP interests.

Figure 1: Survey on motivations of sellers; source: Preqin

Let us look at some of these motivations in more detail:

- Portfolio management: This term includes investors’ desire to take profits when valuations are at peak levels (and upside seems limited), the wish to concentrate portfolios (divest non-core GP relationships) and clean-up exercises such as tail-end sales. With the tendency toward longer fund lives the size of the tail-end issue has grown substantially for many LPs.

- Liquidity management: While distressed sellers are mostly a thing of the past, liquidity remains a

frequently cited motivation for secondaries. The strong performance of private equity as an

asset class relative to other more liquid assets such as bonds has often resulted in institutional investor portfolios being overly tilted to illiquid assets. Hence their desire to rebalance their portfolio. - Change in strategy: A critical topic regarding strategic adjustments is the focus of larger LPs to go direct or through co-investments. Another trend is

the focus of smaller LPs on mid-sized buyout funds, and away from the mega funds. - Fund performance: Industry-wide performance indicators have shown a rosy picture for years, however by far not all private equity funds have done well. Despite the recent bull market, there are hundreds of funds that have performed poorly, and, disappointed investors who have seen enough want to get out.

- Regulations: Various local and global regulatory initiatives, such as the Volcker’s rule or Basel III, caused banks to sell off private equity portfolios over recent years. While the strong performance of major banks lightened the pressure in the US, many European banks still face strong pressure to deleverage further. The focus here seems to be on non-performing loan books, and some private equity books still have to be divested as well.

Selling LP interests in the secondary market is no longer a taboo

Both LPs and GPs have become accustomed to this market and are beginning to appreciate the additional possibilities offered by it. Let us briefly look back to where we have come from and how this market has developed.

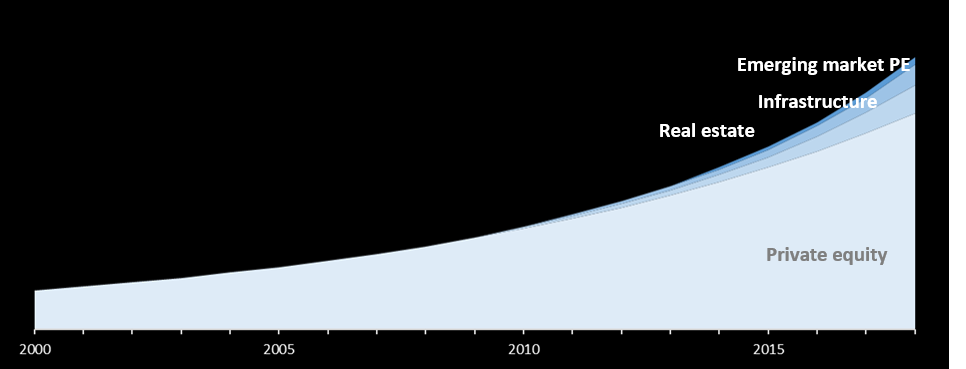

Some of the first LP interests may have changed hands in the 1990s. One could hardly have called it a market yet. In the early 2000s, fund-of-funds started to purchase LP interests on the secondary market. Still, the activity was mostly limited to US buyout and venture funds. As volumes rose, the scope of the market started to expand geographically, and soon spread across other private market segments such as real estate and infrastructure.

In the early 2000s, fund-of-funds started to purchase LP interests on the secondary market.

Figure 2: Illustrative development of secondary markets; source: Multiplicity Partners

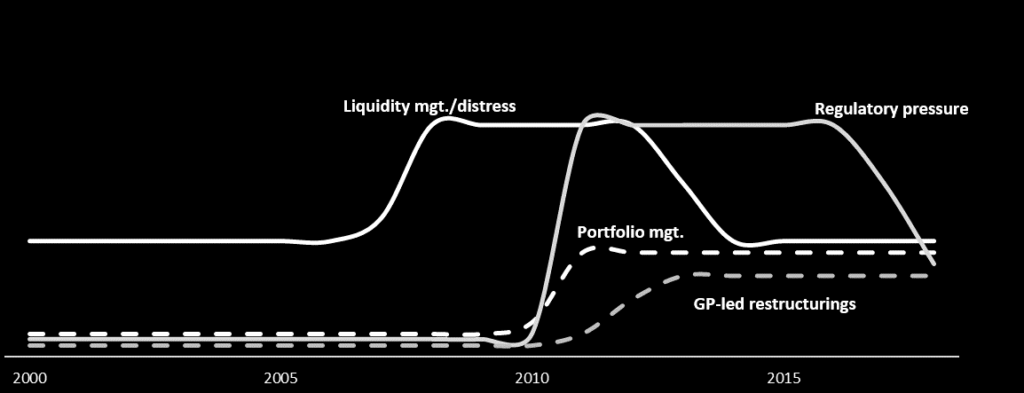

While it started with liquidity-driven sellers, the set of motivations has been subject to massive changes over time.

Figure 3: Illustrative key secondary supply drivers; source: Multiplicity Partner

You may have considered a sale of some of your illiquid assets. Contact us to receive an indicative pricing.

Please write to Andres today at ah@mpag.com, or call him at +41 44 500 4555.