In private equity secondaries, a well-functioning market for LP interests particularly depends on the availability of suitable deal structures. In this educational note we discuss the most common of those structures and how they fit into today’s private equity secondary market.

Deal structures have spurred the creativity of financial engineers

We estimate that the majority of secondary deals are still executed as straight sales.

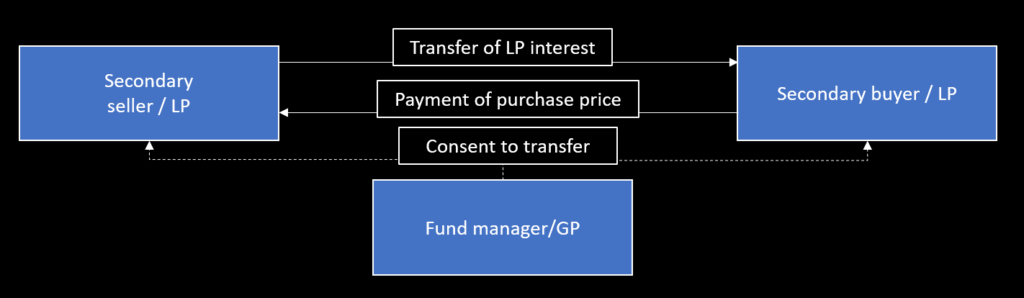

Figure 1: Straight secondary sale of LP Interest (schematic illustration)

Deal volumes have increased in line with the proliferation of new deal types, and the availability of leverage. Here are a few options available to secondary market participants today:

Straight sale: By far the most common secondaries transactions are whole portfolio or single line sales.

- Deferred payments: To achieve a higher price, a seller may provide implicit financing to the buyer (“seller financing”). One example would be allowing the buyer to pay part of the purchase in installments over time.

- Earn-outs: This is a useful deal structure in case the cash flow profile of the assets is difficult to assess and would lead to a secondary price at a high discount to NAV. The buyer would allow the seller to participate in future cash flows (usually above a certain threshold), mitigating the effective discount for the seller if the sold assets exhibit a strong future performance.

- Levered: Instead of getting (implicit) leverage from the seller, we see a significant push of banks to provide leverage for well-diversified portfolio deals. This tends to increase the risk of the buyers, yet allows them to still achieve their 10%+ target returns, if all goes well.

- Staples: These deals are typically initiated by GPs that are raising a new fund. The GP would introduce a secondary deal in one of its older funds to a potential buyer tied to the condition that the LP makes a commitment to the new vehicle.

- GP-led restructurings: Fund restructurings (or recapitalizations) involve a secondary buyer offering LPs in a mature fund an option to exit and simultaneously provide new capital to the GP.

- Direct: A GP, or a large corporate or financial institution, would sell a portfolio of direct investments to a secondary buyer, who will then take over the management itself or find an external GP to take the operational management role.

Late fund stages are becoming en vogue

Historically, secondary buyers were only interested in mature funds, fully invested and ideally well-diversified. As non-traditional and specialized buyers emerge, secondaries on recent vintages and tail-end funds have become increasingly feasible.

Secondaries on recent vintages and tail-end funds are becoming feasible.

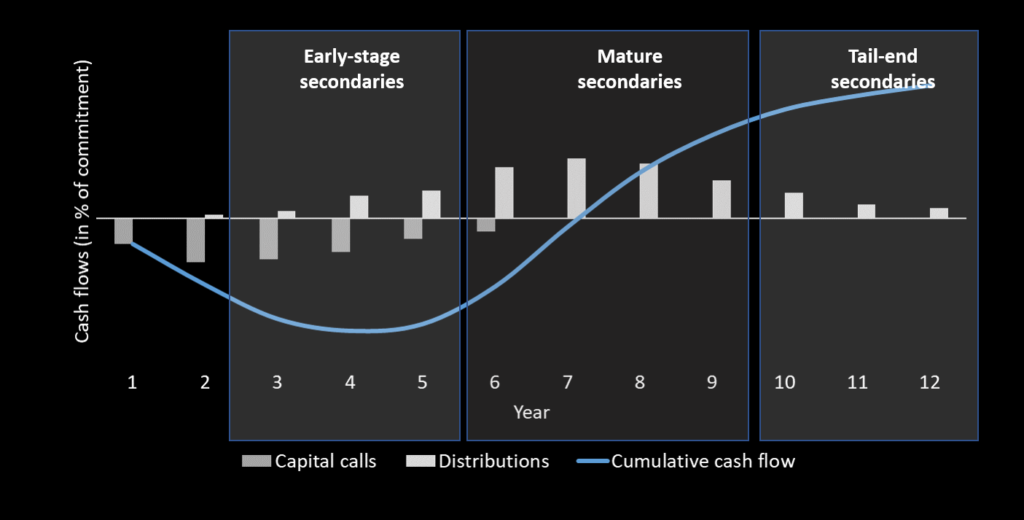

Figure 2: Schematic illustration of the life-cycle of a secondary LP interest

- Early stage secondaries: In these transactions, the buyer relies on his assessment of the GP and adopts a long time-horizon. These so-called manager secondaries tend to be more attractive for buyers such as fund-of-funds or institutional investors than for dedicated secondaries funds.

- Mature secondaries: For these mature funds, a buyer must mainly assess the quality and the valuation of the underlying companies. Hence, these transactions are also called financial secondaries. At this stage, most commitments have been drawn. The largest amount of secondary transactions falls into this category.

- Tail-end secondaries: Towards the very end of a fund’s life, with few residual assets left, a buyer needs to assess the probability and type of restructuring if the GP cannot exit the remaining companies. Aspects such as how much the GP is in the carry may play an important role on how forcefully exits are pursued.

Are you looking to dispose of parts of your private markets portfolio? Contact us to discuss flexible deal structures that accommodate your targets and requirements.

Please write to Andres today at ah@mpag.com, or call him at +41 44 500 4555.